Management Assistance Program

Phishing Scam Targeting Lawyers – June 25, 2025

An active phishing campaign is currently targeting several state bar associations, including the OBA. The attackers’ goal is to catch someone off-guard and prompt actions such as providing login credentials or personal information such as dates of birth or Social Security numbers. Please be aware, and do not fall victim to these scams.

An active phishing campaign is currently targeting several state bar associations, including the OBA. The attackers’ goal is to catch someone off-guard and prompt actions such as providing login credentials or personal information such as dates of birth or Social Security numbers. Please be aware, and do not fall victim to these scams.

What To Watch For

The fraudulent emails are impersonating state bar staff using their real names and titles, and these emails may appear legitimate. Common traits of these scam emails include:

- Sender spoofing: Emails may come from addresses like “johndoe@okbar.virumail.dotcom.” Note that legitimate OBA staff email addresses end with “@okbar.org.”

- Vague or misleading messaging: Often referencing secure communications of document requests.

- Urgent tone: Designed to prompt immediate action without proper verification.

- Example scam message: “As part of our ongoing efforts to ensure the confidentiality and security of sensitive information, we are reaching out to confirm your preference for secure communication.”

Do not reply, click or open any suspicious links or attachments. The best practice is to immediately delete these emails and block the sender.

Phishing Scams – June 24, 2025

Phishing emails are once again on the rise. These emails may appear to have been sent by someone you know and trust, and may even appear to come from someone at the OBA. In many cases, the phishing attempts involve messages claiming to share a file via OneDrive or other cloud-based file sharing services.

Always exercise extreme caution when opening any emails, even if they appear to come from colleagues or known internal contacts. Phishing emails can look very convincing, and attackers are leveraging compromised accounts to make these messages seem more legitimate. If you receive a suspicious email from the OBA, do not respond. Report the email to your IT or security team, and delete the message.

As a reminder, here are a few best practices to stay vigilant:

- Always check the sender’s email address carefully—even if it seems familiar.

- Be cautious with links and attachments, especially those you were not expecting.

- Before typing your username or password into any website, check the URL bar to ensure you are on the legitimate site.

- Report any suspicious emails immediately to your IT or security department, and do not click on any links or open attachments within them.

Summer Scam Season for Lawyers: Why You’re a Target (Again) – June 5, 2025

Scammers don’t take a summer vacation, but they may count on you taking one.

Scammers don’t take a summer vacation, but they may count on you taking one.

Each year, as temperatures rise, so does scam activity targeting small businesses, and that includes law firms. Employees are out of the office, firms run leaner operations, and distracted professionals are more likely to click, trust, or process without full review.

Last fall, we warned Oklahoma lawyers about a check scam targeting law firms, especially those handling collections, real estate, and other transactions involving client funds. Unfortunately, this scheme is back. Several attorneys have recently reported receiving counterfeit cashier’s checks from fraudsters posing as new clients.

As before, the scammers engage the firm for help collecting or transferring funds, then send a fraudulent check and request that the firm disburse funds before it bounces.

How the Scam Works

- Initial Contact: A scammer reaches out, often via email, posing as a potential new client needing legal help with a collection, debt resolution, divorce settlement, or real estate transaction.

- Engagement Letter: The scammer may complete a legitimate-looking engagement process, including signed documents and even photo IDs to appear credible.

- Delivery of Funds: They send a cashier’s check or other official-looking instrument and ask the lawyer to deposit it into the trust account.

- Urgent Instructions: Soon after, they request a disbursement or refund (typically a wire transfer) claiming urgency due to a business deal that didn’t go through, overseas move, or a similar excuse for a refund.

- The Bounce: Days or even weeks later, the bank notifies the firm that the cashier’s check was fraudulent. At that point, the wired funds are no longer available, and the firm is responsible for the loss.

Here’s how to protect yourself this summer:

- Slow down fund disbursement: Never release funds from your trust account until the check has fully cleared—not just posted.

- Verify client stories independently: Use known-good contact info and verify identities by phone or secure channels.

- Strengthen internal controls: Use a two-person review process for any trust account disbursement involving new clients or unusual amounts.

If you believe your firm has been targeted or defrauded, report the incident at www.ic3.gov and alert your bank immediately.

Cyber Alert: Law Firms Targeted by Silent Ransom – June 4, 2025

The FBI has issued a warning about a cybercriminal group known as the Silent Ransom Group (SRG), also called Luna Moth or Chatty Spider, which is actively targeting U.S. law firms. These attackers are using convincing email and phone scams to trick staff into giving them remote access to office computers. Once inside, they steal sensitive data and demand ransom payments to prevent public exposure of that data.

SRG often pretends to be a company billing for a fake subscription. The emails instruct the recipient to call a number to cancel the charge. More recently, they’ve targeted law firms by impersonating law firm IT staff in phone calls, directing employees to join fake support sessions that give the hackers access to the system. Once in, they quickly copy client files using legitimate tools that may not trigger antivirus software, then they send a ransom demand.

to cancel the charge. More recently, they’ve targeted law firms by impersonating law firm IT staff in phone calls, directing employees to join fake support sessions that give the hackers access to the system. Once in, they quickly copy client files using legitimate tools that may not trigger antivirus software, then they send a ransom demand.

Law firms are encouraged to take precautions like training employees to recognize phishing attempts, establishing clear IT communication protocols, enabling multi-factor authentication, and regularly backing up data. This alert highlights the importance of cybersecurity awareness for all employees in a legal office, not just IT teams.

Electronic Filing Scam Targets Attorneys – Nov. 6, 2024

Attorneys across the country are being targeted with fake electronic filing notifications, in which emails purporting to come from the federal Judiciary’s Case Management/Electronic Case Files (CM/ECF) system lead recipients to a malicious website with computer viruses.

Attorneys across the country are being targeted with fake electronic filing notifications, in which emails purporting to come from the federal Judiciary’s Case Management/Electronic Case Files (CM/ECF) system lead recipients to a malicious website with computer viruses.

According to the IT Security Office for the Administrative Office of the U.S. Courts, the fake Notices of Electronic Filing prompt recipients to reply immediately. Recipients are then sent an email containing a link to access fake case documents that direct users to a malicious website.

To avoid becoming a victim of the scam, be sure to always validate cases and case documentation directly through your local federal court’s CM/ECF system. Never download attachments or click on links from unofficial or questionable sources.

If you receive a suspicious email regarding a federal court case, contact the federal court in your jurisdiction before opening any attachments or links.

Visit the federal court scams page for more information about scams targeting people who interact with the federal courts.

Counterfeit Check Scams Targeting Law Firms – Oct. 8, 2024

The FBI is warning of a counterfeit check scheme in which fraudsters target law firms engaged in collections work by deceptively contracting their services to ultimately defraud them. It may focus on any type of representation where a lawyer is hired to assist in the transfer or collection of money, e.g. real estate, collection matters, collaborative law agreements in family matters, etc. This scenario continues to be replayed as part of a sophisticated scam that targets collections lawyers, and the scope is constantly evolving. Learn how the scheme works.

The FBI is warning of a counterfeit check scheme in which fraudsters target law firms engaged in collections work by deceptively contracting their services to ultimately defraud them. It may focus on any type of representation where a lawyer is hired to assist in the transfer or collection of money, e.g. real estate, collection matters, collaborative law agreements in family matters, etc. This scenario continues to be replayed as part of a sophisticated scam that targets collections lawyers, and the scope is constantly evolving. Learn how the scheme works.

Though the structure of the schemes are primarily the same, there can be some variation regarding the reasoning for the debt and engagement of services as well as the types of fraudulent checks.

How to Protect Yourself

- Be suspicious of requests or pressure to take action quickly. A number of potential victims were able to successfully identify the fraudulent check by adhering to policies which required a delay or hold on the funds until confirmation that the debtor’s check had indeed cleared into their client trust accounts.

- Consider additional financial security procedures, such as two-step verification or telephone calls (subjects tend to prefer written correspondence), to verify transaction details and identity information, prior to wiring funds.

- Contact your financial institution immediately and request that they contact the financial institution where any wire transfer was sent to determine if it is able to be recalled or the funds frozen in the deposit account.

The FBI requests victims of an internet crime file a complaint with the Internet Crime Complaint Center (IC3) at www.ic3.gov.

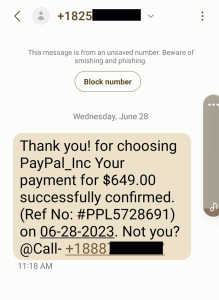

Text Message Scams – June 29, 2023

Your smartphone notifies you that you have transferred money via PayPal. Since you have transferred no money recently, that merits a reaction. So, you click on the link in the message to straighten things out, right? No! Stop!

A rule of using the internet is anytime you get an email or text message prompting you to do something urgently, the first thing you should do is stop and take a deep breath. Scams by text messages are increasing. Whether it is money being taken from you or an email from “OBA” notifying you a client has filed a grievance and you should click to learn the client’s name, the more urgently you want to react, the more likely you should pause first. And, no, the OBA does not notify lawyers of grievances that way.

A rule of using the internet is anytime you get an email or text message prompting you to do something urgently, the first thing you should do is stop and take a deep breath. Scams by text messages are increasing. Whether it is money being taken from you or an email from “OBA” notifying you a client has filed a grievance and you should click to learn the client’s name, the more urgently you want to react, the more likely you should pause first. And, no, the OBA does not notify lawyers of grievances that way.

When was the last time you had a problem because you delayed responding to an unexpected email from a stranger? Never, right?

And if you are worried about your PayPal account or any other account, log in the way you normally would check your records. Do not click on a link in the message you have received, even if it purports to be from PayPal or your bank. For more information on this text message scam, see "Watch Out for This PayPal Text Message Scam" from tech.co.

Ransomware Coming on Strong! – June 22, 2023

March 2023 broke ransomware attack records, according to Bleeping Computer. Many observers believe that powerful new artificial intelligence tools will allow criminals to mount even more sophisticated malware attempts. Protect your firm by applying all security updates, requiring password managers and two-factor authentication (2FA) and implementing other security tools. For more information read Sharon Nelson’s post "Ransomware Coming on Strong in 2023!"

FBI Alert – June 30, 2022

Attorney trust account scam promises high-dollar commissions on medical equipment purchases. The scam has resulted in approximately $2 million in losses to date.

Click here to learn more.

You may have been taught in the past that cashier's checks are just as good as cash. That is not the case today because forged cashier’s checks are often indistinguishable from real ones.

Oklahoma lawyers are being targeted – don’t let it happen to you. OBA MAP Director Jim Calloway says it's a new version of an old scam.

Jim Calloway breaks it down so you know what to look out for:

-

- You receive an unusual communication out of the blue where someone has decided to hire your law firm. Often it is for something that your firm doesn't even normally handle. But they offer a flat fee of $10,000 or more.

- The criminals send you a large cashier's check for your fee. Other variations on the theme include large cashier’s checks to purchase equipment.

- The deal somehow goes bad; the equipment was sold to another buyer, or the party whose suit you were going to defend dismisses the suit.

- The “client” is sorry for the trouble and says while you need to return the money promptly, you should keep $5,000 or $10,000 for your trouble when you often have done little or no work. The lawyers wire the balance back.

- A week or so later, the law firm gets a notice that their trust account is overdrawn because the initial huge cashier's check was a forgery and bounced. It takes a while to catch this because it is a forgery on an actual account like a mortgage company clearinghouse account that has millions of dollars in it. So the person who reviews the checks coming in is the one who will ultimately catch it.

- The lawyer may not appreciate that cashier’s checks from strangers are not as good as cash today because of these scams and also doesn’t know it could take a while to discover a forged cashier's check in an often churning escrow account. It is rarely possible to reverse a wire transfer if done in a few hours. But by the 24-hour mark, that money will have been wired through several accounts and is gone for good. That could lead to financial difficulties and even disciplinary action. Don’t let this happen to you!

The FBI urges firms or victims of an internet scam to file a complaint with the Internet Crime Complaint Center.