Oklahoma Bar Journal

Residential Restrictive Covenants: The Amendment Process Under 11 O.S. Section 42-106.1

By Kraettli Q. Epperson

Kirk Fisher | #457012537 | stock.adobe.com

THE NATURE OF RESTRICTIVE COVENANTS

As any title professional is aware, residential subdivisions are typically encumbered by restrictive covenants (restrictions). Such restrictions are initially imposed by the landowner of the real property (usually the developer) through either 1) inclusion in a freestanding dedication deed,[1] 2) incorporation as part of the official subdivision (or addition) plat[2] or 3) after 1975, as part of a real estate development.[3]

“Restrictive covenants are contractual in nature, and contracts generally may not be amended absent the consent of all parties.”[4] A restriction creates a property interest that runs with the land, which is not a legal easement but is a creature of equity in the nature of an easement, and (because it “runs with the land”) it is binding on all initial parties to the contract and also all future owners.[5] Such a restriction “forbids or requires certain uses of the real property which it covers” and “confers vested rights in those owners who desire to own property where the subject uses are either required or forbidden.”[6]

AMENDING RESTRICTIVE COVENANTS

Restrictions can be amended if permitted by the express terms of the restrictions; however, in the absence of such provisions, case law has held that it takes a 100% vote of all the current landowners to amend such restrictions.[7] The terms “lots” and “parcels” are used interchangeably in this article.

However, in 1995, 11 O.S. 42-106.1 was enacted to permit the amendment of restrictions with less than a 100% vote. Such process was probably created because 1) practically speaking, getting 100% agreement from all members of a diverse group of landowners is difficult, if not impossible, and 2) public policy probably favors keeping operational restrictions “up to date.” Under this new statute, such an opportunity for amendment is granted – even if initial restrictions are silent on allowing such amendment – once the initial restrictions have been of record for a substantial period of time (i.e., 10 or 15 years). This statute allows the landowners of 70% of the parcels to amend the restrictions after they have been filed of record for 10 years and allows the landowners of 60% of the parcels to amend after 15 years. Note that a lesser percentage is allowed if the restrictions expressly permit such lesser amount.[8]

It should be noted that adding a provision to existing restrictions to create a homeowners association and, if desired, to require the homeowners to participate in a mandatory homeowners association (association) was not possible before 2002.[9] In 2002, the Legislature added part (D) to 11 O.S. §42-106.1 to allow the amendment of existing restrictions to create an association and to make it a mandatory association. This particular amendment – to create an association and to make the existing or new association mandatory – was only effective against “the successors-in-interest of all record owners,” who would then be required to pay dues to the association.[10] Such amendment creating a mandatory association does not require a time period to pass (e.g., 10 or 15 years) before it can be approved, but it does require a “vote of not less than sixty percent (60%) of the record owner of parcels.” It also adds the requirement for two advance notices to be published in the 1) newspaper and 2) newsletter.

Such association (if it is an entity) typically is granted the duty and the authority to enforce the restrictions, collect dues to maintain the subdivision infrastructure (such as a community clubhouse or park) and provide subdivision services (such as landscaping, security patrols and holiday events). Otherwise, the restrictions usually empower individual lot owners to enforce the restrictions, although both the association and the lot owners could be granted such authority.

As stated in the Real Estate Development Act:[11]

A. An “owners association” may be formed by the owner or owners of real estate development for the purpose of:

-

- providing management, maintenance, preservation and control of commonly owned areas or any portion of or interest in them, and/or

- enforce all mutual, common or reciprocal interests in or restrictions upon all or portions of such separately owned lots, parcels, or areas, or both.

FRAMEWORK FOR VALIDLY ADOPTING AN AMENDMENT OF RESTRICTIONS

At first glance, the operative statute to amend restrictions (11 O.S. Section 42-106.1) may appear to be straightforward and complete in itself where it states:

A.1. The restrictive covenant has been in existence for at least ten (10) years and the amendment is approved by the owners of at least seventy percent (70%) of the parcels contained in the addition or the amount specified in the restrictive covenant, whichever is less;

However, as they say, “The devil is in the details.” When considering how to carry out this statutory procedure (when such statutory provisions are used in lieu of existing amendment provisions in a set of restrictions), there are several questions left unanswered by the limited language of this statute, including:

- What is the required form and content of such written approval by the owners?

- How are the owners correctly identified and then listed in the approval document?

- If a particular owner is an individual or an entity, what are the specific approval and signature requirements, if any?

- Does such approval have to meet standard real property rules concerning joinder of spouses and providing a proper legal description?

- Does this approval form need to include an acknowledgment for each person’s signature so that it can be filed of record in the local land records (as required by the statute) in order to give constructive notice?

- When there are multiple owners of a particular lot, how do you treat conflicting votes among the joint owners of a specific lot on the proposed amendment?

A review of the statutory framework in Oklahoma for validly executing any real property instrument gives guidance on how to answer these questions. Such rules prescribe the required content, execution, acknowledgment and filing of any real property instrument, such as a deed, restrictions, plat, mortgage, easement or release. These rules are found scattered throughout the various titles in the Oklahoma statutes beginning with the statute of frauds at 15 O.S. §136 (4) and including, but not limited to, Title 16. Conveyances, Title 60. Property and Title 19. Counties and County Officers. Because restrictions impact an “interest in real property,”[12] these real property rules must be followed during the restrictions amendment process and the filing of the related approval documentation.

Any prospective homeowner or prospective lender will want to ascertain which set of restrictions is effective against their land before completing their transaction – is it the original or the amended version? For instance, does the change raise or lower the minimum square footage of the residence being built, allow or prohibit rentals of houses or require higher or lower quality construction materials (such as brick on new construction or on improvements)? The likelihood that future homeowners will, in fact, receive and review a copy of the restrictions before closing on their purchase is, practically speaking, probably low. Nevertheless, 1) state statutes require that a copy of the restrictions be provided to the buyer at or before closing,[13] and 2) the buyer takes the title subject to the restrictions (if recorded) through constructive notice, even if the restrictions are not reviewed by the buyer.[14] If a party wants the amended version of the restrictions to be binding on present and future owners through constructive notice, rather than only the pre-amendment version, such amended set must be filed of record in the county land records where the land is located after being acknowledged.[15] If seen by the prospective interest holder, they have actual notice, even if the restrictions are not recorded.[16] The statute also expressly calls for the filing of the amended restrictions.[17]

David | #491736981 | stock.adobe.com

CONTENT OF NOTICE AND AMENDED RESTRICTIONS

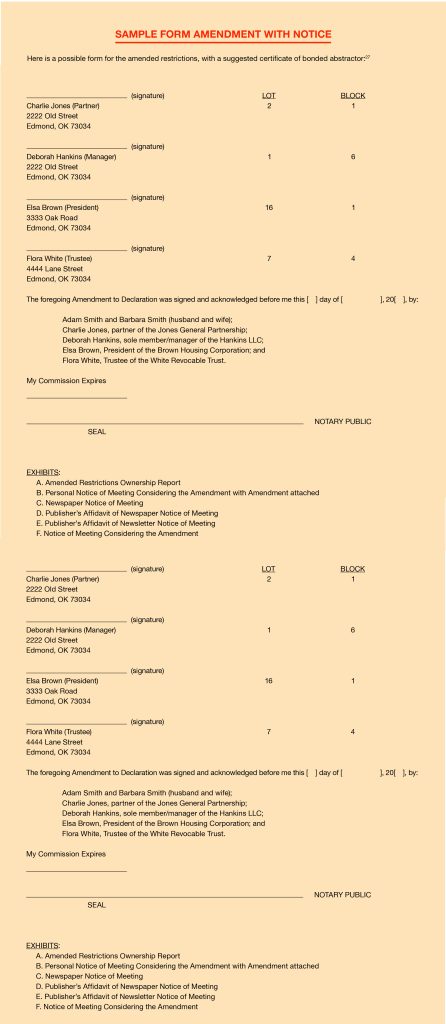

At a bare minimum, the language in the recorded amended restrictions will need to confirm that the amendatory steps were followed 1) as set forth in the express provisions in the restrictions themselves for amending the restrictions[18] or 2) as set out in the statute. Such confirmation will need to be documented by having the amended restrictions state on their face the following facts or, as appropriate, to have the following attached:

- The fact that the original restrictions were in existence for the period either set forth in the restrictions or for 10 years (or 15 years), as appropriate.

- The fact that the amendment was approved by a) the percentage set forth expressly in the initial restrictions or b) at least 70% (or 60%, as appropriate) of the owners of all the parcels (lots) in the residential addition.

- The content of the approved amendment:

a) [Insert content of amendment] - A copy is attached of the 30-day written advanced notice of meeting scheduled and held to approve this particular amendment (if a meeting is called in lieu of simply collecting the needed acknowledged signatures), including a copy of the proposed amendment and the location, date and time of the meeting, with proof that such notice was provided to all of the homeowners, such as an affidavit of hand delivery or proof of certified mail delivery.

- (Note: This is only required if creating a mandatory association.) A copy is attached of the notice of meeting, which was published in a newspaper in the county where the land is located at least 14 days before the meeting, with proof that such notice was published, such as a publisher’s affidavit.

- The fact that notice of the meeting was published in the neighborhood newsletter, presumably at least 14 days before the meeting (if scheduled and held), by attaching a copy of the notice to the amendment with proof that such notice was published, such as a publisher’s affidavit. (Note: In the absence of the existence of a newsletter, it is probable that this requirement would be waived with proof of such absence verified by an affidavit from an association officer or other knowledgeable person – perhaps inserted into this amendment.)

- An official list (g., abstractor’s ownership list) of all the signing owners of lots in the addition (lot owners) is attached to the amendment,[19] and such lot owners must be matched to the “specific legal description” for their lot (not a street address).[20]

- The fact of the approval of the required minimum number of lot owners (60% or 70%) must be reflected on the amendment by:

a) the signature of each lot owner, using substantially the same name as on the ownership list,[21]

b) if an individual (not an entity), stating marital status and, if married, joined by spouse[22] and

c) if an entity, signed by the proper representative (g., partner, trustee, president, LLC member or manager).

9. For the amendment to be acceptable for recording by the county clerk – because such filing is required by the statute – each signature on the amendment must be acknowledged, as on any real property instrument, 1) to authenticate the identity of the signers and 2) to confirm the signing was executed as the “free and voluntary act and deed for the uses and purposes therein set forth.”[23]

As noted above, a copy of the notice of meeting (if held in lieu of pre-meeting balloting or if creating a mandatory association that requires a meeting), the proof of mailing and the publisher’s affidavit for both the newspaper and the newsletter need to be attached to the amended restrictions, which is filed of record in the local land records, to give constructive notice.

It has been suggested that it should be sufficient to attach to the amended restriction an affidavit from a “knowledgeable” person declaring that each and every one of the required statutory steps had been taken. However, there is no official repository created by statute 1) to store the supporting documents and 2) to give notice of the existence and content of these supporting documents – other than the county land records themselves.[24] Therefore, the cautious approach is for proof of the satisfaction of each of the required statutory steps to be placed directly in the county land records.

ALTERNATIVE VOTING MECHANISM

Some attorneys and nonattorneys, who are taking steps to amend restrictions, attempt to use pre-meeting ballots or pre-meeting proxies. A pre-meeting ballot is probably acceptable, so long as it contains all the required content and formalities for a real property document: 1) content of amendment, 2) marital status (if married), 3) title of official (if entity), 4) legal description, 5) signature and 6) acknowledgment.[25]

Unless the existing restrictions expressly allow the use of proxies – and prescribe the details of their content and the procedure to use them – the procedure will arguably need to follow the normal steps to create a power of attorney dealing with real property, meaning: 1) identity of person granting the power, 2) content providing sufficient detail as to what actions can be taken by the appointed attorney in fact, 3) name of attorney in fact, 4) marital status if an individual, 5) title of official if an entity, 6) legal description, 7) signature(s) and 8) acknowledgment.

CONCLUSION

The statute (11 O.S. §§41-101 et seq) fails to contain the details a title examiner would like to see to confirm that the steps had actually been taken. In the face of such silence, it is necessary 1) to take a cautious approach to protect a valuable property interest and 2) to look outside the statute to find guidance in other statutes and case law on how to prepare, execute, acknowledge and record real property-related instruments.[26]

ABOUT THE AUTHOR

ABOUT THE AUTHOR

Kraettli Q. Epperson is a partner with Mee Hoge PLLP in Oklahoma City. He received his J.D. from the OCU School of Law in 1978 and practices in the areas of mineral and real property title disputes. He chaired the OBA Title Examination Standards Committee from 1988 to 2020 and taught Oklahoma Land Titles at the OCU School of Law from 1982 to 2018.

ENDNOTES

[1] See Bumgarner v. Pruitt, 421 P.2d 651, 1966 OK 254.

[2] 11 O.S. Section 41-101 et seq.; note that the dedication of the identified streets, alleys, ways, commons or other public use areas is a conveyance of the interest (fee simple or easement) to be held and regulated by the municipality.

[3] 60 O.S. Sections 851 et seq.

[4] 2000 OK AG 38, ¶12.

[5] Nonetheless, as explained in O’Neil v. Vose, 1944 OK 26, 193 Okla. 451, 145 P.2d 411: “[W]e are not unmindful of the legal right of owners of adjoining properties to bind themselves by enforceable contract, restraining the use of their property for an unlimited period of time, wherein each separate owner grants to the other owners a right in his property in the nature of an easement and which shall run with the land and be binding upon the several property owners as well as all future owners, who succeed to title with actual or constructive notice of such contract or agreement and its terms.” Id. at ¶14, 145 P.2d at 414. A restrictive covenant, therefore, creates a property interest although that interest is created by contract. Vranesevich v. Pearl Craft, 2010 OK CIV APP 92, ¶6, 241 P.2d 250, 253-254.

[6] Wallace’s Fourth Southmoor Addition to City of Enid, In re, 1994 OK CIV APP 73, para. 10, 874 P.2d 818, 821.

[7] Wallace’s Fourth Southmoor Addition to City of Enid In re, 1994 OK CIV APP 73, para. 9, 874 P.2d 818, 821; 2000 OK AG 38, para. 12.

[8] Note that according to 2000 OK AG 38, para. 2, this statute is confined “to efforts to change or alter existing restrictive covenants [and] does not permit homeowners to add a new restrictive covenant.”

[9] See 2000 OK AG 38, ¶16.

[10] 11 O.S. §42-106.1 “D. The recorded restrictive covenants on property contained in a residential addition may be amended by the addition of a new covenant creating a neighborhood association for the addition that would require the mandatory participation of the successors-in-interest of all record owners of parcels within the addition at the time the amendment is recorded. The amendment must be approved by the record owners of at least sixty percent (60%) of the parcels contained in the addition.”

[11] Real Estate Development Act, 60 O.S. §§851 et seq, (adopted in 1975), 852 (A).

[12] Vranesevich, ¶6.

[13] 60 O.S. §857.

[14] 25 O.S. §§10-13; 16 O.S. §§15-16.

[15] Id.

[16] Id.

[17] 11 O.S. §42-106.1 (D)(3).

[18] If the amendment is approved by following the express procedure set forth in the initial restrictions, proof of following those procedures will need to be documented in a manner similar to the documentation set forth in the statute discussed below.

[19] This list must be based on a verifiable public record showing ownership of the lots; for the convenience of the title examiner, while it is not expressly required by the statute, the amended restrictions might include a list certified by an abstractor – based on the county assessor’s ownership records or the abstractor’s own records. The next owner of a lot – after an amendment to the restrictions – and their title examiner will need to know not just that their prior lot owner agreed to the amendment of the restrictions but that the required percentage of all lot owners who approved the amendment were, in fact, the record owners of such lots.

[20] 19 O.S. §298 provides: “A. Every county clerk in this state shall require that the mandates of the Legislature be compiled with, as expressed in Sections 287 and 291 of this title, and for that purpose, every instrument offered which may be accepted by the county clerk for recording, affecting specific real property whether of conveyance, encumbrance, assignment, or release of encumbrance, lease, assignment of lease or release of lease, shall be an original or certified copy of an original instrument and clearly legible in accordance with the provisions of subsection B of this section, and shall by its own terms describe the property by its specific legal description ... ;” See Plano Petroleum, LLC v. GHK Exploration, LD, 2011 OK 18 ¶9, 250 P.3d 328, which provides: “The error was compounded by a willingness to quiet title based on an instrument which contains absolutely no legal description of the legal premises. There is a long-standing black letter rule of law that ‘the description of the premises conveyed must be so certain and definite as to enable the land to be identified.’” Arbuckle Realty Trust v. Southern Rock Asphalt Co., 1941 OK 237, ¶8, 116 P.2d 912, 914. See also Key v. Key, 1963 OK 288, ¶22, 388 P.2d 505, 511. “That requirement is more than a legal nicety, it is essential for recording in the county clerk’s office and for establishing a chain of title. In fact, a deed that does not sufficiently describe the property interest conveyed is void on its face.” Coley v. Williams, 1924 OK 323, 224 P. 345, 346.

[21] See Oklahoma Title Examination Standard 5.1 Abbreviations and Idem Sonans.

[22] See 16 O.S. §4; and see Oklahoma Title Examination Standard:

7.2 MARITAL INTERESTS AND MARKETABLE TITLE

[23] 16 O.S. §§15-16, §33, §95; 49 O.S. §112 (2), and §119; 60 O.S. §178.11; Oklahoma Title Examination Standard 6.6.

[24] Crater v. Wallace, 1943 OK 250, ¶11, 140 P.2d 1018, 1020, “The general rule is that the record of an instrument entitled to be recorded will give constructive notice to persons bound to search for it. But constructive notice being a creature or statute, no record will give constructive notice unless such effort has been given to it by some statutory provision.”

[25] 16 O.S. §20 & 91; See Oklahoma Title Examination Standards TES 14.2, 14.3, and 14.3.1; See also Panama Timber Co. v. Barsanti, 1980 OK CIV APP 18, FN 3 (absence of recorded power of attorney makes instrument invalid) and Pierce v. Bank One, 2001 OK CIV APP 62, ¶¶9-10 (instrument is invalid if power of attorney is not recorded).

[26] Comments on these issues are invited by this author.

[27] EXHIBIT “A”

CERTIFICATE OF BONDED ABSTRACTOR

AMENDED RESTRICTIONS OWNERSHIP REPORT

STATE OF OKLAHOMA )

)ss:

COUNTY OF SMITH )

The undersigned bonded abstractor in and for Smith County, State of Oklahoma, does hereby certify that the following Ownership Report is true and correct according to [(a) the current year’s tax rolls in the office of the County Treasurer of Smith County, Oklahoma, as updated by the land records of the County Clerk of Smith County, Oklahoma, based on the last conveyance or final decree of record as shown in the land records of the County Clerk of Smith County, Oklahoma] of the specified properties set forth below are the owners; or (b) the land records of the County Clerk of Smith County, Oklahoma, or (c) with the addresses and legal descriptions as shown on the attached pages numbered from (1) to ( ), inclusive.

NEW TOWNE HOMEOWNERS ASSOCIATION

[DATE]

NAME LOT BLOCK

Adam Smith 13 5

1111 Attorney Way

Edmond, OK 73034

____________________

[ETC.]

Dated: at 7:30 AM

[ ] Company

By: __________________________________

Abstractor License No. __________

OAB Certificate of Authority No. __________

File No. __________

Originally published in the Oklahoma Bar Journal – OBJ 95 Vol 7 (September 2023)

Statements or opinions expressed in the Oklahoma Bar Journal are those of the authors and do not necessarily reflect those of the Oklahoma Bar Association, its officers, Board of Governors, Board of Editors or staff.