Oklahoma Bar Journal

Fractionation or Consolidation? The Land Buy-Back Program for Tribal Nations (2012-2022)

By Conor P. Cleary

Sergey Kamshylin | #50486766 | stock.adobe.com

On Nov. 22, 2022, the Land Buy-Back Program for Tribal Nations (LBBP) came to an end. Authorized by Congress as part of the settlement of the Cobell v. Salazar litigation, the LBBP included a $1.9 billion fund that was used to purchase small fractional interests in trust or restricted allotments owned by individual tribal members and consolidate those purchased interests into tribal ownership.

“Fractionation” is the undivided ownership of small interests by multiple co-owners in a single tract of land. Without adequate estate planning, the number of ownership interests increases exponentially with each successive generation as more co-owners inherit increasingly smaller interests in the land. Fractionation impairs efficient land use and resultingly decreases the value of the property. Consolidating and aggregating small fractional interests of multiple owners into a single tribe centralizes decision-making regarding the property, thereby increasing its usability and enhancing its economic value.

Over the course of a decade, the LBBP paid $1.69 billion to individual landowners and increased tribal ownership in more than 50,000 tracts of allotted land, including nearly 2,000 tracts in which the tribe now owns the entire interest.[1] Tribes are now able to use these properties for a variety of purposes that promote tribal sovereignty and economic development. The LBBP represents the federal government’s most successful land consolidation initiative after the U.S. Supreme Court greatly limited the effectiveness of previous efforts. Without a sustained commitment to reducing fractionation in Indian Country, however, it is estimated that the number of fractionated interests will return to pre-LBBP levels by 2038.[2]

This article explains the genesis of the fractionation problem in Indian Country, the negative effects of fractionation, early efforts to address the issue and the creation and design of the LBBP. It concludes with some practical pointers for attorneys when advising clients about mitigating the effects of fractionation.

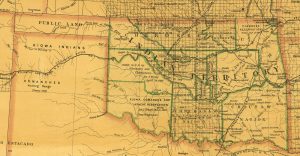

ALLOTMENT

The history of federal Indian policy is often described as occurring in distinct phases or eras.[3] Perhaps the most significant of these – in terms of the impact it had on Indian tribes as well as its enduring effects in the present – was the “allotment era.”[4] After the Civil War, westward expansion accelerated, creating greater demand for expansive swaths of Indian land that only half a century before had been promised to Indian tribes in perpetuity in exchange for removal from the eastern United States.[5] “Starting in the 1880s, Congress sought to pressure many tribes to abandon their communal lifestyles and parcel their lands into smaller lots owned by individual tribe members.”[6] There were varying motivations for the allotment policy, but the central animating features were a desire to assimilate Indian tribes and peoples to Western norms and institutions and to free Indian land for non-Indian settlement.[7] “[A]dvocates of the policy believed that individual ownership of property would turn the Indians from a savage, primitive, tribal way of life to a settled, agrarian, and civilized one.”[8] “[W]ith lands in individual hands and (eventually) freely alienable, white settlers would have more space of their own.”[9]

The allotment policy proved disastrous for Indian tribes and tribal members. Almost immediately, approximately 60 million acres of “surplus land” left after individual tribal members received their allotments were opened to non-Indian settlement.[10] An additional 27 million acres passed into non-Indian hands through the removal of restrictions on the alienation of allotments.[11] The removal of these restrictions freed the allotments from federal supervision and also subjected them to state taxation.[12] Subsequently, “[t]housands of Indian owners disposed of their lands by voluntary or fraudulent sales; many others lost their lands at sheriffs’ sales for nonpayment of taxes or other liens.”[13]

Recognizing the deleterious effects allotment had on Indian tribes and their lands, Congress repudiated the policy in 1934 with the passage of the Indian Reorganization Act.[14] The first section of the act provided that “hereafter no land of any Indian reservation ... shall be allotted in severalty to any Indian.”[15] It extended the trust period of allotments indefinitely and restored any unsold surplus lands to tribal ownership.[16] It authorized tribes to reorganize through the adoption of constitutions and bylaws and charters of incorporation.[17] It facilitated the rebuilding of tribal land bases by authorizing the purchase of lands for tribes to be held in trust for their benefit by the United States.[18] Despite these advances, however, “Congress made no attempt to undo the dramatic effects of the allotment years on the ownership of former Indian lands.”[19]

FRACTIONATION

Phoenix | #227674967| stock.adobe.com

Allotment was not only harmful because of the literal loss of land. Even for those allotments that remained – and continue to remain – in Indian hands, the policy nevertheless has resulted in “constructive dispossession”[20] through the fractionation of ownership of allotted lands. Indian families may continue to own their allotments, but because that ownership often is shared among hundreds if not thousands of co-owners, “the result on the ground is realistic deprivation of any of the other potential benefits of that land ownership.”[21] In this way, “the legacy of allotment”[22] endures despite the formal end of the policy in 1934.

A simple example illustrates the problem of fractionation. Most allotments in Oklahoma were issued around 1900. If the recipient of the allotment – the “allottee” – had three children, and each child had three children of their own and so on, within six generations (approximately 120 years or roughly the present day), there would be 243 heirs and potential co-owners. If you increase the average to four children, within six generations there would be over 1,000 heirs and potential co-owners today.

The sheer number of co-owners “prevents efficient use of the property [and] impedes individual and community economic development.”[23] Title to the property is often unclear because there is little incentive to probate an estate with such a small ownership interest. Without a clear title, many prospective purchasers or lessees view transactions involving the land as too risky. Moreover, under federal regulations governing the leasing of allotted lands, no lease may be granted on a highly fractionated tract unless 50% of the co-owners consent.[24] With so many co-owners, it is often time-consuming to locate and obtain the consent of the requisite number of owners, a factor that may dissuade potential lessees from pursuing the transaction. Often, the value of the transaction is simply not worth the administrative hurdle for both the lessee and the owners. For example, the U.S. Supreme Court recounted an instance where a tract of land producing $1,080 in annual income had 439 owners, none of whom received more than $1 in annual rent.[25] This property is extremely difficult to lease because, on one hand, it is inherently challenging for the lessee to obtain consent from hundreds of co-owners, and on the other hand, the owners have very little incentive to agree since they stand to receive so little benefit. The unfortunate reality is that many allotments remain entirely unproductive for these reasons.

EARLY EFFORTS TO ADDRESS FRACTIONATION

Even during the allotment era, the federal government began to realize the problem of fractionation.[26] By the 1960s, fractionation was the subject of hearings and studies by the U.S. Congress.[27] In 1983, Congress passed the Indian Land Consolidation Act (ILCA). Among other things, the ILCA tried to reduce fractionation by mandating the escheat of very small fractional interests back to tribes upon the death of the owner.[28] The original version of the ILCA provided that a fractional interest of 2% or less of the total acreage of the allotment that had earned its owner less than $100 in the preceding year would not descend by intestacy or devise to the owner’s heirs but would instead escheat to the tribe.

The U.S. Supreme Court struck down this provision of the ILCA as an unconstitutional taking without just compensation.[29] It found the restriction on the ability to freely pass the property interests to one’s heirs “extraordinary.”[30] Congress amended the law in 1984 to try to cure these deficiencies, but the Supreme Court struck down the amended version of the ILCA for the same reasons in 1997.[31]

THE LAND BUY-BACK PROGRAM FOR TRIBAL NATIONS

In Babbitt v. Youpee, the Supreme Court observed that although forced escheat of small fractional property interests violated the Constitution, the government was free to “pursue other options to achieve consolidation including Government purchase of the land.”[32] Congress followed this advice in authorizing the LBBP.[33] The LBBP was part of the settlement of the Cobell v. Salazar litigation. Congress appropriated $1.9 billion for a land consolidation fund for the purchase of fractional interests in trust or restricted allotments. Owners had to be paid the fair market value of their fractional interests.

By all accounts, the LBBP was a resounding success. Although up to 15% of the fund could be spent on administrative and implementation costs, less than 8% was spent, freeing up more than $135 million for the purchase of additional fractional interests.[34] More than 1 million fractional interests were consolidated, comprising about 2.9 million acres.[35] Tribal ownership increased in more than 50,000 different tracts, and the number of tracts in which tribes now own a majority interest increased by approximately 100%.[36] More than 123,000 willing sellers received $1.69 billion in total payments.[37]

Despite the overwhelming success of the program, there were shortcomings. Most fundamentally, the $1.9 billion that Congress authorized was not sufficient to comprehensively address the fractionation problem. The LBBP “was unable to implement land purchases at 63 percent of the approximately 150 unique locations with fractionated land, involving nearly 100 Tribes.”[38] Not surprisingly, fractionation continued to increase on reservations not included in the LBBP, including a 283% increase on the Cherokee Reservation and a 63% increase on the Muscogee (Creek) Reservation.[39] Without further consolidation efforts, the number of fractional interests will return to pre-program levels within 15 years.[40]

PRACTICAL TIPS FOR ATTORNEYS

Attorneys in Oklahoma can play a productive role in mitigating the effects and expansion of fractionation. First, practitioners should familiarize themselves with the various laws governing the alienation and descent of interests in restricted and trust allotments.[41] This includes probate codes enacted by tribes as allowed by the ILCA. One set of rules may apply to certain tribes while another set applies to others.[42] Failure to follow the applicable law can defeat the intent of Indian owners and result in a clouded title or property passing through intestacy rather than according to an invalid will or trust.[43] Second, attorneys who represent clients owning interests in trust or restricted allotments should counsel their clients on the effects of fractionation. When these effects are fully understood, owners may pursue a different approach than originally contemplated. Third, attorneys can offer constructive solutions to avoid the worst effects of fractionation. For example, estate planning attorneys may recommend distributing interests in restricted or trust allotments by will to a single heir while providing other property in the estate to other heirs. In certain circumstances, restricted or trust property may be placed in a trust approved by the secretary of the interior.[44] A real estate attorney might suggest partitioning a trust or restricted allotment so that each heir receives their own discrete tract of property rather than sharing the larger property with several co-owners. There is no shortage of creative solutions, but many of those solutions will not be apparent to attorneys unless they understand the origins and effects of fractionation and the legal options available to curb its worst excesses.

CONCLUSION

The Land Buy-Back Program for Tribal Nations successfully reduced fractionation in Indian Country during its decade-long existence. Now that the program has expired, however, fractionation is projected to return to pre-program levels within 15 years. Attorneys can play a role in avoiding further fractionation by providing clients owning interests in trust or restricted allotments creative estate planning and real estate advice that encourages consolidation rather than fractionation.

Author’s Note: The views expressed are those of Mr. Cleary and do not necessarily represent the views of the Department of the Interior or the United States government.

ABOUT THE AUTHOR

ABOUT THE AUTHOR

Conor P. Cleary is the Tulsa field solicitor for the U.S. Department of the Interior. He has an LL.M. in American Indian and Indigenous law from the TU College of Law and a J.D. from the OU College of Law.

ENDNOTES

[1] Land Buy-Back Program for Tribal Nations, Ten Years of Restoring Land and Building Trust: 2012-2022 at 1, available at https://bit.ly/48OTi6i (last accessed Jan. 3, 2024) (hereafter, Final Report).

[2] Id.

[3] See, e.g., F. Cohen, Handbook of Federal Indian Law §1.01 at 7-8 (Nell Jessup Newton ed. (2012)) (classifying the “eras of Native policy” into “six time frames”[:] “(1) Post-Contact and Pre-Constitutional Development (1492-1789); (2) The Formative Years (1789-1871), (3) Allotment and Assimilation (1871-1928), (4) Indian Reorganization (1928-1942); (5) Termination (1943-1961); and (6) Self-Determination and Self-Governance (1961-present).”

[4] McGirt v. Oklahoma, 140 S. Ct. 2452, 2463 (2020).

[5] See H. Craig Miner, The Corporation and the Indian (1989).

[6] McGirt, 140 S. Ct. at 2463 (citation omitted).

[7] See Judith Royster, “The Legacy of Allotment,” 27 Ariz. St. L. J. 1, 9 (1995).

[8] Id.

[9] McGirt, 140 S. Ct. at 2463 (citing F. Hoxie, A Final Promise: The Campaign to Assimilate the Indians, 1880-1920, at 14-15 (2001)).

[10] Royster, supra note 7, at 13.

[11] See id. at 10-12. Removal of restrictions could occur through the expiration of a certain “trust period” (often, 25 years) or through the issuance of a so-called “fee patent” that unilaterally and automatically removed the restrictions. See id.

[12] See generally Conor Cleary, “The Stigler Act Amendments of 2018,” 91 OBJ 50 (2020).

[13] Royster, supra note 7, at 12 (footnote omitted).

[14] Act of June 18, 1934, ch. 576, 48 Stat. 984 (codified as amended at 25 U.S.C. §§5101-5129).

[15] Id., §1, 25 U.S.C. §5101.

[16] Id., §§2, 3, 25 U.S.C. §§5102, 5103(a).

[17] Id., §§16, 17, 25 U.S.C. §§5123(a), 5124.

[18] Id., §5, 25 U.S.C. §5108.

[19] County of Yakima v. Confederated Tribes & Bands of the Yakima Indian Nation, 502 U.S. 251, 255 (1992).

[20] Jessica Shoemaker, “Like Snow in the Spring Time: Allotment, Fractionation, and the Indian Land Tenure Problem,” 2003 Wis. L. Rev. 729, 730 (footnote omitted).

[21] Id.

[22] See Royster, supra note 7.

[23] Shoemaker, supra note 20, at 731.

[24] See 25 C.F.R. §162.012(a). A highly fractionated tract is one with 20 or more owners. Id.

[25] See Hodel v. Irving, 481 U.S. 704, 712-13 (1987).

[26] See Shoemaker, supra note 20, at 730 n.7 (quoting Kenneth H. Bobroff, “Retelling Allotment: Indian Property Rights and the Myth of Common Ownership,” 54 Vand. L. Rev. 1559, 1616 (2001) (“As early as 1892, Indian Agents were reporting problems of fractionated heirship.”)).

[27] Id. at 744-45 (citing Comm. on Interior and Insular Affairs, 86th Cong., Indian Heirship Land Study 27 (Comm. Print 1960); Indian Fractionated Land Problems: Hearings on H.R. 11113 Before the Subcommittee on Indian Affairs of the House Committee on Interior and Insular Affairs, 89th Cong. 6, 31-32, 35 (1966)).

[28] Escheat is “a reversion of property to the state in consequence of a want of any individual competent to inherit.” Escheat definition, Black’s Law Dictionary (2d ed. 1910), available at thelawdictionary.org (last accessed Jan. 6, 2024).

[29] See Hodel v. Irving, 481 U.S. 704 (1987).

[30] Id. at 716.

[31] See Babbitt v. Youpee, 519 U.S. 234 (1997).

[32] Id. at 242 (quoting Youpee v. Babbitt, 67 F.3d 194, 200 (9th Cir. 1995)).

[33] See Claims Resolution Act of 2010, P.L. 111-291, 124 Stat. 3064, 3066-70 (Dec. 8, 2010).

[34] Report at 10.

[35] Id. at 24.

[36] Id. at 27.

[37] Id. at 26.

[38] Id. at 44.

[39] Id.

[40] Id. at 50.

[41] See, generally, Conor Cleary, “The Stigler Act Amendments of 2018,” 91 OBJ 50 (January 2020); Casey Ross-Petherick, “Estate Planning for Indian Land in Oklahoma: A Practitioner’s Guide,” 84 OBJ 1027 (May 2013).

[42] See Casey Ross, “Probate of American Indian Trust Property: The Lawyer’s Role,” 87 OBJ 287 (February 2016). For example, estates of Five Tribes and Osage members containing interests in restricted allotments are probated in Oklahoma state court while estates containing interests in trust allotments are probated administratively through the Department of the Interior. See id.; see also Act of Aug. 4, 1947, chap. 458, §3(a), 61 Stat. 731 (estates containing Five Tribes restricted allotments); 43 C.F.R. Part 30 (probate of estates containing trust allotments).

[43] See Casey Ross-Petherick, supra note 41, at 1027 (“As a result of this individualist approach employed by the federal government in crafting its American Indian policy, practitioners must understand the general rules of federal Indian law, but must also look for deviations that are tribe-specific.”).

[44] See, e.g., Act of October 21, 1978, Pub.L. No. 95-496, §6, 92 Stat. 1660 (Osage trusts); Act of Jan. 27, 1933, chap. 23, §2, 47 Stat. 777 (Five Tribes trusts).

Originally published in the Oklahoma Bar Journal – OBJ 95 No. 4 (April 2024)

Statements or opinions expressed in the Oklahoma Bar Journal are those of the authors and do not necessarily reflect those of the Oklahoma Bar Association, its officers, Board of Governors, Board of Editors or staff.