Oklahoma Bar Journal

You Mean the Government Can Control My Guns? The Estate Planner's Guide to Firearm Distribution in Oklahoma

By Gale Allison, Rebecca Wood Hunter and Vale Gonzalez

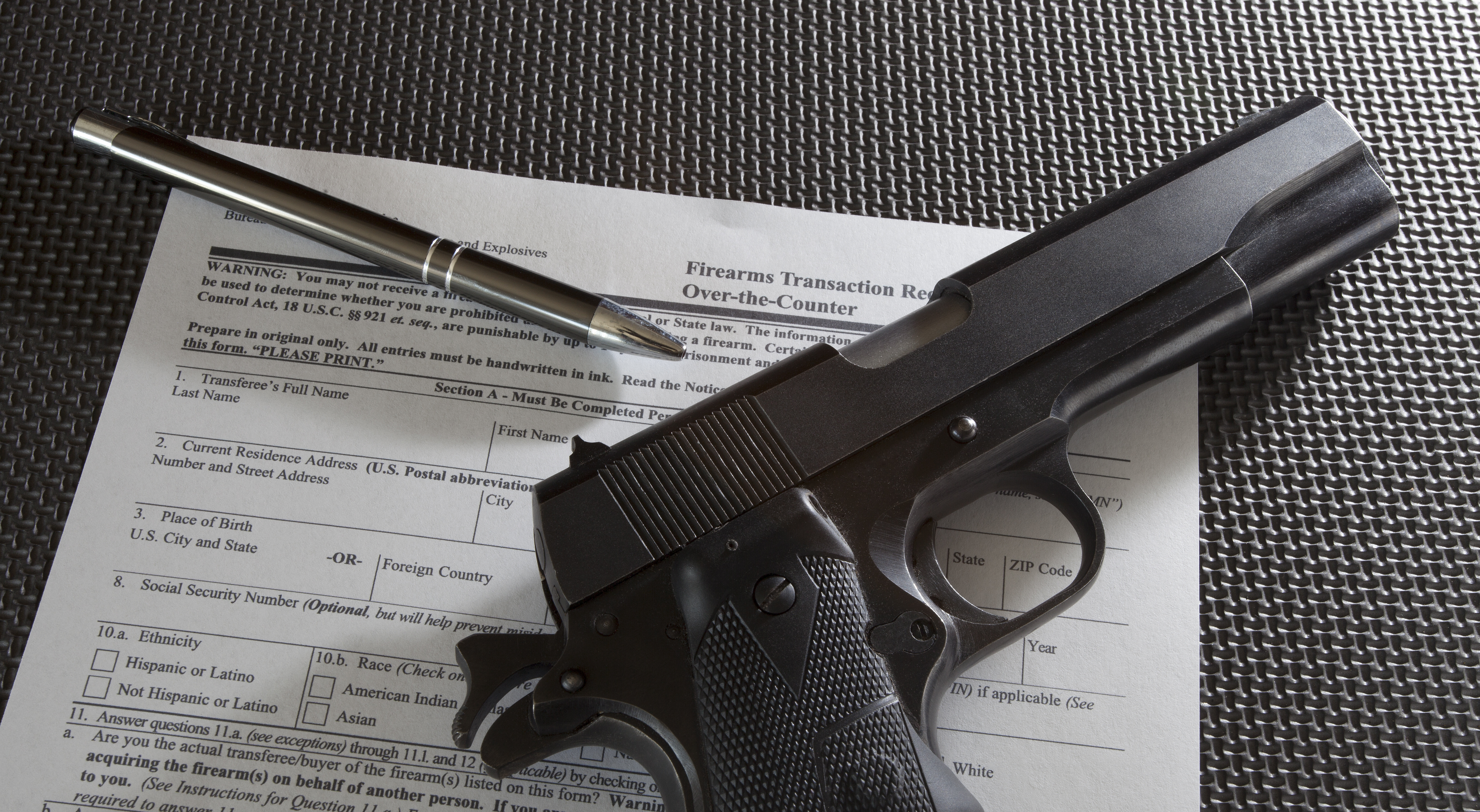

99280673 | © Guy Sagi | fotolia.com

Illegal firearm transfers have potentially severe consequences to both the transferor and the transferee. Estate planning and probate attorneys need to be aware of these potential traps and inform their clients that fines of up to $10,000 and jail time of up to 10 years (or both) can be imposed for improper transfers of certain firearms.1 Additionally, establishing estate planning tools to protect the parties involved in the transfer will assist in complying with federal and state law, helping to protect fiduciaries and beneficiaries.

THE ESTATE PLANNER’S ROADMAP

For estate planners, having one more issue to consider, on top of the other hundreds of issues which need to be covered, is not easy. Even with the best of intentions by trustees and estate representatives, improper firearm transfers can lead to criminal charges, fines and jail time. To best prepare estate planning documents and provide proper guidelines for fiduciaries, estate planners must understand the complexity of federal and state laws as these laws relate to the transfer. Once the laws are understood, estate planners can customize estate planning documents to provide protections to reduce the potential for fiduciary liability and to ensure that fiduciaries and beneficiaries are not inadvertently breaking the law.

Gun trusts structured to comply with the National Firearms Act (NFA)2 provide several incentives that make them the go to vehicles of choice for NFA firearms. NFA firearms have more restrictions and legislation than other firearms due to their destructive potentials. Since NFA firearms are heavily regulated, there are numerous issues involved in the transfer of these firearms. The benefits of the NFA gun trust include: 1) allowing for use of the NFA firearms by multiple individuals during the gun’s ownership by the trust, not just use by a single owner; and 2) assistance in facilitating transfers to qualified beneficiaries.

FEDERAL FIREARM CONTROL – THE ESSENTIALS

There are two federal acts that affect how a fiduciary of a decedent’s trust or estate must distribute firearms. These laws are known as the Gun Control Act (GCA)3 and the NFA4. Each of these laws limit its scope to certain types of firearms. The purpose of the GCA is to control interstate transfers of all guns, while the NFA places license requirements for possession of certain types of firearms considered more dangerous.

The GCA defines the word firearm in a broad sense and includes all firearms, embracing those firearms contained in the NFA. The NFA defines firearm in a narrower sense than that of the GCA’s definition. To remove confusion, this article references GCA firearms as “firearms” and NFA firearms as “NFA firearms.” The guide also uses “gun” to reference both firearms and NFA firearms. This article limits itself to federal and Oklahoma law, though other state laws5 must be reviewed if a firearm is involved in an interstate transfer, later discussed.

The main objective for estate planners and probate attorneys is to make a legal transfer of guns. The following questions must be answered to assist in making a legal distribution:

- What is the gun’s category? It can either be a GCA firearm or a NFA firearm. If it is a NFA firearm, the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) requires forms from the fiduciary and the beneficiary. A NFA firearm without proper ATF registration and a proper transfer on ATF forms makes the firearm contraband and it must then be forfeited to the ATF or risk jail time and fines.

- Where is the beneficiary residing? Is it an intrastate or interstate transfer? How do I get the firearm to the beneficiary? In intrastate transfers, using common carriers or physically handing the weapon to the beneficiary is allowed. If interstate, the transfer can be accomplished by physically delivering the firearm to the beneficiary, using a federal firearms licensee (FFL) (later discussed) or mailing to a FFL through USPS, UPS or FedEx (which each have their own set of restrictions).

- Is the fiduciary aware of any issues which would make the receiving beneficiary ineligible to possess a firearm? If so, you may not legally transfer. Knowingly transferring firearms to a restricted person is illegal. If the transfer is intrastate, federal and Oklahoma restrictions apply. If the transfer is interstate, federal law as well as the beneficiary’s residing state laws apply. The law of the beneficiary’s state of residence may have further procedures for transfer of a gun or prevent other categories of individuals from possessing firearms.

- How do I make the transfer legal? If it is a NFA firearm, follow the proper documentation required by the ATF later outlined. If it is a GCA firearm, Oklahoma does not require firearm documentation in an intrastate transfer. If it is an interstate GCA firearm, no transfer documentation is required, unless the beneficiary’s resident state requires it.

These questions should be addressed with your clients so that guidelines can be set out within estate planning documents to ensure compliance with the law during weapon transfers. Knowing if a beneficiary can legally receive the weapon (at the time of distribution) and indicating proper directions on distributions of firearms helps to ensure that the distribution will occur in a legal manner. Furthermore, having a fiduciary instruction package that further details the nuances of gun transfers will aid transfers that comply with legal requirements. If NFA firearms are part of a client’s property, preparing a NFA trust that is specifically structured to block any potential illegal transfers from occurring will reduce the risk of a client’s undesired contact with law enforcement for violation of federal and state laws.

GUN CONTROL ACT

For the GCA to apply, a firearm must be transferred in interstate commerce. A transfer occurring within the same state is not within the scope of the GCA. The GCA provisions never replace state law, only add to it. Since the GCA law does not replace state law, both the fiduciaries and transferee’s residing state law will apply to interstate transfers. To illustrate, a transfer of a firearm between residents of Oklahoma and Texas are required to comply with both Oklahoma and Texas law as well as the GCA.

GCA Firearm Definitions

The GCA defines the type of firearms within its scope. Since the GCA broadly defines firearms, most firearms will be covered by the GCA. Antique firearms, firearms outside the scope of the GCA, can be defined into categories both of which require: 1) the manufacturing of the firearm prior to 1899; 2) the firearm not designed or redesigned for using rim fire or conventional center fire ignition with fixed ammunition; and 3) any firearm using fixed ammunition for which ammunition is no longer manufactured in the United States and is not readily available.6

“Destructive device”7 is a catch-all term which falls within the scope of the GCA. A destructive device generally fits into one of three categories: 1) an explosive, incendiary or poisonous device; 2) any kind of weapon that has a barrel larger than one-half inch in diameter (an exception exists for shotguns if the attorney general finds the weapon suitable for sporting purposes); or 3) any parts designed or intended for use to create any of the previously mentioned items.8

Federal Firearm Licenses

The GCA created a transferring system to control firearm trafficking by using federal firearm licensed dealers (FFLs) – special license holders typically required when a firearm is transferred interstate.9 FFLs include gun brokers and dealers who issue background checks and ensure transfers follow state and federal laws. The general rule is that fiduciaries are not required to use a FFL for transfers occurring through bequest or intestate succession.10 For the rule to apply, it requires the beneficiary receiving the firearm do so through bequest or intestate succession, and transferees must be able to lawfully possess the firearm in their residing state. However, the best practice for interstate transfers would be to transfer by way of a FFL.

NATIONAL FIREARMS ACT

The NFA requires additional licensing and regulation for possession of certain guns the federal government deems more dangerous, and the act details the process necessary to legally transfer a NFA firearm. The NFA, unlike the GCA, is not limited to interstate commerce and applies to all NFA firearms regardless of the fiduciary’s and beneficiary’s residency. Some firearms in the NFA include short-barreled shotguns and rifles, machine guns and explosive devices.11 Penalties are substantial if the NFA is violated.12 Since the NFA has specific requirements for a transfer to be legal, placing specific restrictions within a NFA gun trust helps secure all parties involved from receiving fines and criminal charges. Understanding what restrictions are necessary to include in estate documents is crucial to prepare for any potentially illicit transfers.

ILLEGAL TRANSFERS – RESTRICTED PERSONS

A fiduciary who is prohibited from owning or possessing a weapon of any kind should not be appointed as the representative of an estate or be the trustee of a trust in which any guns or weapons are involved. Doing so could impose severe penalties and potential jail time for the individual.

In an initial assessment of distribution of guns, fiduciaries must evaluate whether they have knowledge or reasonable cause to believe that any beneficiary is a person who is a “restricted person.” A restricted person is a person the GCA or state law has forbidden from acquiring or owning a gun. In the estate planning context, this will likely require a review of the client’s knowledge of the prospective beneficiaries. The law punishes individuals, including fiduciaries, who knowingly transfer firearms to these restricted persons. If the proposed gun transfer is to a beneficiary outside of Oklahoma, then the beneficiary’s state law may have additional categories of restricted persons. Fiduciaries must comply with federal law and the beneficiary’s state laws or risk criminal liability. Assessing the laws of the beneficiary’s estate and applying restrictions within the estate planning documents to provide for a contingent beneficiary streamlines the process in case of a restricted beneficiary.

Federal Law

Categories of restricted persons are found in the GCA. Keep in mind both non-NFA and NFA firearms are subject to this GCA. A restricted person includes anyone convicted of a crime punishable by a term exceeding one year, a fugitive, an unlawful user of or someone addicted to a controlled substance, someone who has been committed to a mental institution or adjudicated to have a mental defect, an alien, a service member who has been dishonorably discharged, anyone who has renounced his or her U.S. citizenship, most instances where someone has had a protective order entered against him or her in domestic related matters and anyone convicted of a misdemeanor for domestic violence.13

Oklahoma Law

Oklahoma law has two relevant statutes of concern to a fiduciary. In Oklahoma, it is unlawful to knowingly furnish a firearm to an incompetent person14 or to transfer firearms to convicted persons.15 While it is not required that a fiduciary investigate the status of the person receiving the firearm, it is strongly recommended that reasonable steps are taken to deliver guns to only nonrestricted individuals. Fiduciaries do not have an affirmative duty to issue a background check in Oklahoma, but they may be required to if the beneficiary’s state law requires it, or if the fiduciary has reasonable cause to believe the beneficiary is a restricted person. Nevertheless, care should be taken by the fiduciary if there is any reasonable basis to suspect the person may fall into the category of a “restricted person.” Since no laws exist in Oklahoma establishing an affirmative duty on the fiduciary to conduct a thorough investigation prior to a transfer, discussing potential liabilities during the estate planning stage is essential.

Fiduciary Duties

There is a distinction between federal and Oklahoma law regarding a fiduciary’s duty to determine whether an individual is a restricted person for purposes of a potential transfer of a gun. Federal law indicates that a fiduciary cannot convey the gun to any person who the fiduciary “knowing or having reasonable cause to believe” may be a restricted person, while Oklahoma law uses the term “knowingly,” seeming to indicate that there is less of a burden of investigation as to the restricted status of the beneficiary. The laws seem to indicate that to avoid criminal liability, the fiduciary must simply establish that she has no reasonable cause to believe that person is a restricted person. However, the better practice would be to do some investigation to determine that the beneficiary is not clearly a restricted person. Additionally, a good practice might include having the beneficiary sign an affidavit that he or she does not fall into the category of a restricted person. If there is reasonable cause for concern that a beneficiary might be a restricted person, a fiduciary should follow up with a background check prior to transfer.

METHODS OF DISTRIBUTION

A fiduciary has different options available when distributing a firearm, and the options vary depending on the beneficiary’s state of residency. If the beneficiary is an out-of-state resident, the GCA does not bar the transfer, but certain obstacles can present themselves if mailing is the desired distribution method. There are three available methods of distribution, which are: 1) physically handling the firearm; 2) mailing the firearm to a FFL; and 3) mailing directly to a non-FFL individual. Although the following methods apply to all firearms, NFA firearms have additional requirements and paperwork which will be discussed later.

Physically handing the firearm to the beneficiary is the simplest of all the methods of distribution. It does not matter if the beneficiary is an Oklahoma resident or not, the fiduciary can legally hand the firearm to the beneficiary. However, if it is a NFA firearm, ATF forms and approval from the ATF are necessary for a legal transfer.16

A fiduciary, unless they are a licensed gun dealer or broker, is considered a non-FFL individual. Although a fiduciary is allowed to transfer the firearm interstate by mail, it may be a difficult method to use. Reviewing the ever-changing policies of courier services prior to mailing from a non-FFL individual to another non-FFL is difficult, can lead to violations and is not recommended; additionally, finding a carrier to mail directly to the beneficiary may be problematic. Mailing to a FFL is the best practice for delivery to a beneficiary out of state.

ADDITIONAL REQUIREMENTS FOR NFA FIREARM TRANSFERS

The ATF oversees NFA firearm transfers. The ATF requires fiduciaries and beneficiaries to supply certain documents prior to transferring the NFA firearm. A typical NFA transfer takes approximately six to eight months so starting the process early is crucial. Once the fiduciary determines he or she must transfer a NFA firearm, the fiduciary must attempt to locate any registration forms tied to the NFA firearm. If no license or documents exists, the fiduciary must contact the ATF and send proof of executor’s appointment, or authority through trust, so registration documents can be released to fiduciary. If the NFA firearm is not registered, it is considered contraband and must be forfeited to an ATF office.

If the NFA firearm is registered, the fiduciary must file Form 5 Application for Tax Exempt Transfer and Registration of Firearm) found on the ATF website, as well as documents showing: 1) the executor’s power, such as by will or court order appointing executor; 2) documents showing the beneficiary’s right to the NFA firearm such as a probated will with a decree of distribution or a trust; and 3) a FBI Form FD-258 containing beneficiary’s fingerprints. No transfer should occur until the ATF has approved it. If the transfer is to an out-of-state beneficiary, the NFA requires a fiduciary to file Form 20 (Application to Transport Interstate or to Temporarily Export Certain National Firearms Act Firearms) with the ATF.

NFA GUN TRUSTS

A NFA gun trust is a creature of state law made specifically for NFA firearms. These trusts are often referred to as “gun trusts.” The ATF will consider a gun trust valid as long as it appears valid on its face. Like other trust assets, NFA firearms held in gun trusts become nonprobate assets. One of the key benefits to a gun trust is that it allows more individuals access to the firearm (without a gun trust, there are strict rules over who can use a NFA weapon and unauthorized use is subject to criminal penalties), subject to the care and responsibility of the trustee, as well as allowing the trustee access to the firearm.17 Gun trusts must be approved by the ATF and have required forms, fingerprinting, background searches and notification to a chief law enforcement officer that must be submitted. Typical approval time with the ATF generally runs six to eight months. Although non-NFA firearms can be part of a NFA trust, it would not be wise to include them since NFA trusts place heavy restrictions and limitations on the firearms. The better practice is to include non-NFA firearms in a traditional trust. With a NFA gun trust, three different types of instructions must be placed in the gun trust so the trustee can adequately enforce the trust and comply with federal law: 1) the language of the trust must ensure proper transfer procedures occur; 2) the trustee must notify the proper authorities if a firearm is moved to another state; and 3) clear provisions must be contained in the trust that outline the exact forms necessary when the firearm is transferred to a beneficiary.

The gun trust should contain a provision that limits the trustee’s power to transfer, dispose, sell, assign or otherwise transfer the NFA firearm unless ATF approval is acquired. This provision serves to inform the trustee of his duties and obligations so ATF requirements are met and serves to counter the presumptions that trustees can dispose of property as any owner would in a normal trust. Additionally, the power of the trustee to transport NFA firearms should be limited as well. Since the GCA limits the transfer of certain NFA firearms, a provision within the trust should limit the transfer until after ATF approval is granted through Form 20.

Revocation of a gun trust can lead to criminal liability and civil penalties. The ATF considers revocation a transfer. That can lead to issues if the trust is dissolved. For example, if A, B and C create a gun trust that holds a machine gun and later the trust is dissolved, where would the firearm go? To guard against this potentially dangerous outcome, it is suggested that, for gun trusts with multiple settlors, a provision be included in the trust allowing for one specified settlor who would pay the other settlors their fair share of contribution for the guns included in trust if the trust were to be dissolved. Appropriate transfer forms would have to be completed with the ATF.

A transfer by revocation is not illegal on its face but can be dangerous since it can be an illegal transfer without proper precautions and approved paperwork. Keep in mind that a transfer must be documented by following all NFA procedures required by the ATF. Prior to revocation, a Form 4, fingerprinting the transferee and notifying a chief legal enforcement officer are required for a legal transfer to occur since the firearm is moving from the trust to

a person.

As a safeguard provision, a gun trust should contain a provision that a revocation by the settlor is not allowed until ATF approval is received, and the gun trust should further provide that the settlor cannot alter or remove this same provision. An alternative provision would be to completely disallow changing the provisions of the trust unless necessary to comply with the law. While this is a much harsher alternative, it would disallow settlor revocation and prevent against tampering with the trust which might result in an illegal transfer.

CONCLUSION

Great care should be taken when advising clients on the transfer of any type of gun or other weapon by will or trust to avoid any liability to a future fiduciary and carrying out the wishes of a decedent. For additional information, it is suggested that the ATF website and related documents be reviewed for updates.

Authors' Note: Rebecca Wood Hunter is the author of Westlaw’s Bogert’s Trusts and Trustees, June 2018 Update chapter “Revocable Trusts §1089 Gun Trusts.”

ABOUT THE AUTHORS

Gale Allison has four decades of estate, trust and tax experience as an estate and trust lawyer and consultant. A former litigator for the federal government and estate tax attorney for the IRS, she is now in private practice with Schaffer Herring PLLC in Tulsa and mediates business, estate/trust, elder care and family issues exclusively through Dispute Resolution Consultants.

Rebecca Wood Hunter is the founder of Rebecca Wood Hunter PLLC law office located in Coweta. She has a general civil practice with a heavy emphasis in estate planning, probate and family law matters. She speaks across the state on various topics related to estate planning.

Vale Gonzalez graduated in December 2018 from the TU College of Law. He has a B.A. in criminology from the University of Texas at Dallas. Fluent in Spanish and English, he has worked in estate and trust law, federal and state criminal defense and pro bono immigration cases.

1. 26 U.S.C. §5871.

2. Pub. L. No. 90-618, 62 Stat. 1214 (codified as amended at 18 U.S.C. §§921-931 (2012).

3. Pub L. No. 90-618, 62 Stat. 1213 (codified as amended at 18 U.S.C. §§921-931 (2012).

4. Pub. L. No. 73-474, 48 Stat. 1236 (codified at IRC Ch. 53) (June 26, 1934).

5. The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) publishes a reference guide with regard to state laws. However, state laws should be specifically checked as they are constantly revised and renumbered and the ATF’s manual was last updated in 2011. ATF P 5300.5; //www.atf.gov/firearms/docs/state-laws-and-published-ordinances-firearms-2010-2011-31st-edition-atf-p-53005.

6. 18 U.S.C. §921 (g).

7. 18 U.S.C. §921 (a) (4).

8. Id.

9. A great source of information regarding FFLs is located on this form within the ATF website: //www.atf.gov/resource-center/docs/0813-firearms-top-12-qaspdf/download.

10. 18 U.S.C. §922(a)(3)(A).

11. 26 U.S.C.S. §5845 (a), (b), & (e); Unlawful constructive possession, an issue found in U.S. v. Turnbough, 1997 U.S. App. LEXIS 11886, *6 (7th Cir. May 1997) found that the government can find a defendant to have constructive possession of a firearm when the individual had ownership, dominion or control of the place the firearm was stored. However, the court did state “that if a firearm is owned by the trust and the owner’s spouse is also designated as a trustee, the spouse then would have full permission to use the NFA item held in the trust and could not be prosecuted for unlawful possession of the firearm.”

12. 26 U.S.C. §5871.

13. 18 U.S.C. §§922(g).

14. 21 O.S. §1289.10.

15. 21 O.S. §1239.12.

16. Additional laws apply for crossing state lines with guns.